All Defined contribution articles – Page 117

-

Opinion

OpinionPLSA: RQM guides savers to quality at-retirement products

The Pension Quality Mark’s Matthew Doyle makes the case for clear guidance and signposting to quality at-retirement products.

-

News

Education and advice needed for future of saving

Closing the advice gap is crucial to preventing poor outcomes, as the need for savers to be educated about what will be necessary for retirement and the risks they face has increased.

-

News

News'Patchwork quilt' of solutions threatens drive for transparency

Regulators and consumer groups have been warned against installing a “patchwork quilt” of solutions to increase transparency in asset management, as remedies to hidden charges within funds begin to emerge.

-

Opinion

OpinionHow to take some of the worry out of market volatility

Large falls in financial markets have the potential to seriously knock the confidence of defined contribution savers. A 2014 DC member survey, for example, underlined a troubling degree of aversion to sudden falls in pension savings.

-

News

RQM: Driving up standards or duplicating regulations?

The Pensions and Lifetime Savings Association has launched its Retirement Quality Mark for drawdown, but some have questioned the need for the standards in their current form.

-

News

Pensions dashboard prototype to launch by next spring

The Treasury has said it will be working with 11 pension providers to release a prototype of the pensions dashboard by March 2017.

-

Features

FeaturesCAF exits multi-employer scheme to set up own fund

The Charities Aid Foundation has withdrawn from a multi-employer defined benefit pension plan and established a new DB scheme, removing its exposure to other employers’ pension liabilities.

-

Opinion

OpinionHow much trustee education is enough?

Education is essential to get right if we are to solve the pensions and savings crisis. Pensions are complicated, and there is no one solution for the thousands of defined benefit pension funds in the UK.

-

News

Scheme rules may block Treasury's advice allowance plans

The Treasury has opened a consultation on the introduction of a pensions advice allowance, which would allow members of defined contribution schemes to use up to £500 of their pot to pay for tax-free regulated financial advice.

-

Opinion

OpinionHow bright is the future for AE – the DC Debate part 1

In the third DC Debate of 2016, seven defined contribution experts reveal their thoughts on automatic contribution increases, small businesses which mean business, and the possibility of Nest entering the decumulation market.

-

Opinion

OpinionGovernance, guidance and good investing – the DC Debate part 2

Eight panellists discuss the new defined contribution code of practice, the future of free guidance and the role of behavioural finance.

-

Opinion

OpinionDC members and illiquid assets – a perfect match?

Laura Myers from consultancy LCP explains why she believes defined contribution schemes would do members a favour by adding illiquid assets.

-

Features

Norcros moves to mastertrust in bid to improve governance

Bathroom and kitchen products company Norcros is transferring its money purchase section to a mastertrust arrangement to provide "more focused governance" and greater flexibility.

-

News

New DC code of practice: Greater clarity, but niggles remain

The Pensions Regulator this week published its new defined contribution code of practice, clarifying its position on a number of issues, but experts still had questions about its criteria for assessing value for scheme members.

-

News

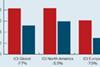

NewsEurope sneezes, the world catches cold: ICI falls 7.7 points in a month

State Street’s monthly Investor Confidence Index for July fell by 7.7 points globally from June, driven primarily by a drop in the European index following recent turmoil in the region.

-

News

DC default funds: Experts divided on best strategy

Huge variations in the risk profiles and investment strategies of DC default fund offerings are putting savers’ retirement provision at risk, according to a recent study.

-

News

The looming DB skills gap: What can be done to slow the brain drain?

Any Other Business: Administration specialist Trafalgar House has urged the pensions industry to address the growing risk of an imminent defined benefit skills gap as schemes wind down and the industry fails to attract a new generation of talent.

-

News

Property or pension: Where downsizing could pay off

A new report warns people planning to downsize to smaller properties and using the proceeds to fund their retirements that the resulting income will only be a fraction of a workplace pension.

-

News

DWP calls for evidence on Nest decumulation services

The Department for Work and Pensions has called for evidence on a proposal to allow Nest to provide decumulation services for its members, and to let it offer services to individuals, employers and other schemes.

-

News

NewsRestructure or rebrand: Finmeccanica’s DC changes

The decision by FuturePlanner, Leonardo-Finmeccanica’s defined contribution pension scheme, to replace two gilt funds with annuity protection funds despite significant structural overlap, raises questions about the extent to which DC restructuring may just be rebranding.