All Defined contribution articles – Page 101

-

News

BT sweetens DB closure with promise of 'hybrid' scheme

BT has announced the closure of its defined benefit scheme and agreed to work with the Communication Workers Union over a forthcoming ‘hybrid’ solution.

-

Opinion

OpinionPutting the USS closure debate into perspective

Amid all the debate over actuarial methodologies and affordability, Society of Pensions Professionals president Hugh Nolan says a quick look at contribution rates gives a valuable insight as to whether the public sector is getting a good deal.

-

Opinion

Keeping the grass greener

Nest: Climate change is not just damaging the planet, it could also have a detrimental effect on our members’ investments.

-

Features

Should pension schemes consider helping the banks?

Analysis: Pension schemes have an opportunity to take advantage of banks’ growing capital requirements.

-

News

Govt 'tempted' by latest Royal Mail CDC proposals

The Department for Work and Pensions is “tempted” to lay regulations facilitating the creation of collective defined contribution schemes, following a recent breakthrough by the team drafting proposals on behalf of Royal Mail.

-

News

NewsVirgin Money introduces financial wellbeing portal for employees

Virgin Money has introduced a financial wellbeing portal to help employees think differently about their relationship with their own money, including retirement savings.

-

Opinion

OpinionHow can employers, providers and trustees work together to ensure good governance?

Rosemary Lemon from Hays, Caroline Roberts from Visit Britain, Nasir Rafiq from Islamic Relief Worldwide, Mark Rowlands from Nest, Ami Bartrip from the Financial Times, Jason Green from Finance & Technology Research Centre and, Andy Cheseldine from Capital Cranfield, discuss the importance of governance in delivering good member outcomes.

-

Opinion

OpinionPutting a value on your future

Helen Dowsey from master trust Nest looks at whether and how value for members can be defined and measured.

-

Opinion

Trustees must delve deeper to provide value for members

The future retirement wealth of millennials hinges on how well trustees can identify value for members, so are there key areas where it can be found?

-

Features

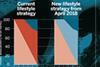

FeaturesJLR drives down costs with DC strategy refresh

UK automotive stalwart Jaguar Land Rover has embarked on a complete overhaul of its defined contribution offering in a bid to drive down costs and improve member outcomes.

-

News

Rising interest rates threaten sponsor covenants, say experts

PLSA Investment Conference 2018: Interest rate and inflation risk could pose imminent threats to schemes and sponsors, while quantitative easing might not have been bad news for schemes, experts have said.

-

News

IDWG chair calls for reform by April

PLSA Investment Conference 2018: Chris Sier, chair of the Financial Conduct Authority’s Institutional Disclosure Working Group, has called for the introduction of reforms promoting asset management transparency by the beginning of April.

-

News

NewsEthics v profit: Should pension funds divest from ‘sin stocks’?

PLSA Investment Conference 2018: A debate on investment in so-called sin stocks threw up questions around what it means for pension funds to act ethically, and whether the regulatory risk associated with such stocks makes divestment financially sound.

-

News

Healthcare company pleads guilty to misleading TPR

A Birmingham-based healthcare company and its managing director have pleaded guilty to misleading the Pensions Regulator about enrolling staff into a workplace pension, after a whistleblower raised the alarm.

-

News

TPR appoints new policy lead

The Pensions Regulator has hired David Fairs as its executive director for regulatory policy, analysis and advice.

-

Opinion

OpinionFinancial and social returns can be easy bedfellows – if the will is there

Nico Aspinall, chief investment officer at the People’s Pension, discusses the obstacles to social investment in DC, and explains how they can be overcome.

-

News

MPs probe pension funds on climate risk amid wider ESG push

MPs are probing pension funds on their approach to climate change risk, as experts expect a ‘multi-pronged attack’ to push environmental concerns higher up trustee agendas.

-

Features

Why DC default investments matter for members

Analysis: More than 90 per cent of savers enrolled in a pension choose to remain in the default option, making it imperative that its investments match members’ needs and offer value for money.

-

News

Lower rises in life expectancy are no longer a blip

The recent slowdown in life expectancy rises has settled into a general trend, according to new data.

-

Features

FeaturesGeneral Medical Council swallows DB closure pill

The General Medical Council is set to close its defined benefit scheme to future accrual from April 1 2018, and is in talks with the trustees regarding additional funding.