All Treasury articles – Page 11

-

Opinion

OpinionSPP: Tax does have to be taxing

Talking Head: A move to tax pensions like Isas is on the cards with far-reaching consequences for long-term saving, says the Society of Pension Professionals’ Duncan Buchanan.

-

Opinion

Holiday reading: Transfers and exit charges – consultation basics

From the blog: The government has today launched a 12-week consultation into pension transfers, early exit charges and the provision of financial advice.

-

Opinion

Reviving the argument for an independent pension commission

An independent pension commission is yet to manifest despite industry support, and it is time to reinvigorate the initiative, says Quantum Advisory’s David Deidun.

-

Opinion

OpinionWhat are pension input periods and why do they matter?

The rules on pension input periods are changing and are about to make life even more complicated, says Ian Neale.

-

Opinion

OpinionEditorial: One hundred days…

Last week saw us pass the somewhat arbitrary milestone of 100 days since the introduction of the freedoms, and providers and commentators rushed to give their take on the story so far.

-

News

NewsTreasury to consult on 'excessive' exit charges

The Treasury has today announced it will consult on easing pension transfers and capping the exit fees charged to pension savers looking to take advantage of the new flexibilities.

-

Opinion

Where employers can help fill the guidance gap

The Budget announced exciting and attractive individual choice at retirement, but greater flexibility demands better information and understanding to help make the most appropriate decisions.

-

Opinion

NAPF: There are still too many unknowns on pension ‘freedoms’

The NAPF’s Graham Vidler sounds the alarm about the continuing lack of detail on how the reforms will work, including the ‘second line of defence’ and retirement risk warnings.

-

Opinion

Altmann: Don’t abandon member safeguards in DB-DC transfers

Talking head: Ros Altmann argues for a £5k-£10k threshold for non-advised DB transfers-out, and says it is vital that members receive proper advice to understand the value of the benefits they are rejecting.

-

Opinion

Is Labour right to argue for extending auto-enrolment to 1.5m lower earners?

In the latest edition of Informed Comment, the Pensions Management Institute’s Tim Middleton discusses proposed changes to the auto-enrolment threshold.

-

Opinion

What the guidance guarantee means for your scheme

In the latest edition of Technical Comment, Barclays’ Lydia Fearn lays out the key questions and steps that schemes need to be asking to make sure they are ready to implement the guidance guarantee.

-

News

Civil service employers face increased contributions after discount rate cut

Participating employers of the Principal Civil Service Pension Scheme will face an increase in their pension costs, due to a reduced discount rate, following government efforts to control public spending.

-

News

Buy-in market predicted to reach new heights

The amount of scheme liabilities underwritten by insurers is expected to reach a record high this year as buy-ins become more affordable and scheme confidence grows, derisking consultants have said.

-

News

Industry calls for better DC risk guidance to hit target outcomes

Industry figures have called for better guidance for defined contribution members to help them choose the appropriate level of risk pre-retirement to achieve their target outcomes.

-

News

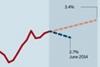

NewsGilt yield falls confound expectations and depress funding

Investment advisers have been taken by surprise by the recent drop in government bond yields which have inflated schemes’ liabilities and delayed derisking strategies.

-

News

Greater DC flex forecasted to raise member savings

Increased at-retirement flexibility for defined contribution members introduced by the Budget may lead to higher member contributions, experts have predicted, which could put pressure on some employers’ pension structures.

-

News

Consultants expect DC flexibility to drive DB member transfers

Defined benefit schemes could see a short-term increase in requests from members to switch their benefits into defined contribution schemes, due to potential government plans to restrict such transfers, benefit consultants have predicted.

-

Features

FeaturesSchemes wary of leveraged infrastructure deals

Chancellor George Osborne used his Autumn Statement to announce a plan to “unlock” pension funding for infrastructure investment. But Owen Walker finds schemes cautious of the risks associated with such deals.

-

Features

Survey: Schemes concerned over PFI mixed messages

Owen Walker finds schemes are being put off investing in infrastructure due to the UK government’s unclear attitude to private finance initiatives (PFI).

-

Features

FeaturesStrathclyde tackles four main infrastructure risks

Strathclyde Pension Fund has agreed in principle to commit £100m to the Pensions Infrastructure Platform (Pip), and has invested £100,000 to help set up the initiative.