All KPMG articles – Page 2

-

News

Field: Big four audit firms 'feasting on Carillion carcass'

The Work and Pensions Committee inquiry into the collapse of outsourcer Carillion has turned its scrutiny on the 'big four' professional services companies, and has published the consultancies' responses to queries about their involvement.

-

Features

FeaturesRobo-trustees: Would you welcome one on your board?

Any other business: For those feeling uneasy about the idea of sitting next to a Star Wars-style droid at a quarterly meeting, you can rest assured we are not likely to witness the rise of the robo-trustee anytime soon.

-

News

NewsNotts expands local property investment

The £4.9bn Nottinghamshire County Council Pension Fund has increased its commitment to local property investment. The fund has added £10m to its local property fund and has expanded the geographical area where it will invest.

-

News

Select committee probes pension freedoms as concerns grow

The Work and Pensions Committee is launching a new inquiry into the pension freedom reforms, asking whether changes are required to better achieve the policy’s objectives.

-

Opinion

OpinionSeparation of services could shake up fiduciary management

Chris Parrott of the Pensions Management Institute and Heathrow Airport Holdings says concerns remain over the appointment and monitoring of fiduciary management, and examines the impact of potential policy changes on the sector.

-

Features

Research and Mifid II: Better quality, lower cost

Analysis: As more asset managers announce their decision to absorb research costs in response to Mifid II, experts speculate that schemes may benefit from better returns and greater transparency.

-

News

NewsBAA switches manager as LDI competition grows

The BAA Pension Scheme is implementing a full interest rate hedge, and has in a first step replaced its liability-driven investment manager to improve “efficiency”.

-

News

NewsScottish Widows switches DC defaults to target drawdown

Scottish Widows has changed the default investment strategy of its group personal pension plan clients to target flexible access drawdown instead of an annuity, as member demand continues to shift away from guaranteed income.

-

News

Default offerings fail to inform savers adequately

More than a third of default fund providers are failing to meet regulatory guidance asking them to clearly state their product’s objective, according to a new report that highlights communications failings in the sector.

-

News

NewsQinetiq shields funding level with boost to LDI

The Qinetiq Pension Scheme has seen a £605m boost to its liability-driven investments and has begun discussions over its long-term future as it nears full funding.

-

Features

FeaturesStrathclyde hails transfer warning effort

A communications exercise warning members of the Strathclyde Pension Fund about the risks of cashing in their benefits has seen the scheme’s membership continue to grow despite declining payroll numbers.

-

Features

FeaturesJohn Lewis Partnership protects future with LDI

The John Lewis Partnership Trust has introduced a liability hedging programme increasing its hedge ratio to 60 per cent, in a move experts said would protect significant recent contributions.

-

Features

FeaturesCornwall agrees new private credit allocation

The Cornwall Pension Fund is set to make an allocation to private credit, an asset class increasingly popular among schemes as tightened bank regulation has opened up a new range of investment options.

-

News

Select committee hears evidence on how to get the self-employed saving

Proposals including an expansion of auto-enrolment and raising class 4 national insurance contributions, aimed at boosting pensions coverage in the UK, have been put before the Work and Pensions Committee as part of its inquiry into self-employed workers.

-

Features

Brexit, pooling and transparency: Top investment stories from 2016

Year in review: Investment fees and the impact of Brexit on schemes’ portfolios stood out among the most salient subjects for pension schemes in 2016, while the ongoing low-yield environment prompted funds to seek higher returns and cut back on costs.

-

Opinion

Illiquid assets: Latest fad or the future of DC investment?

Analysis: Defined contribution investments are still far less sophisticated than those of many defined benefit plans, but there is growing support for making illiquid assets such as infrastructure or private equity part of DC default funds.

-

Features

FeaturesRBS scheme diversifies with US life settlements

The RBS Pension Scheme has made a number of new investments as part of its long-term plan to diversify its portfolio.

-

News

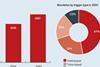

NewsSmaller schemes dive into LDI pools

Smaller schemes are increasingly using liability-driven investment strategies, as the number of pooled mandates powers growth in the market, research this week from consultancy KPMG has shown.

-

Opinion

How schemes can pick the right manager

How can schemes know which manager will perform? In the last part of the Fixed Income Live series, Dalriada’s Simon Cohen, Hymans Robertson’s John Walbaum, Mercer’s Joe Abrams, PGIM’s Edward Farley and Willis Towers Watson’s Chris Redmond discuss whether schemes should let their consultant worry about finding the right specialists and what trustees should be spending their time on.

-

News

Aberdeen transport fund swaps derisking provider in self-sufficiency push

The Aberdeen Council Transport Fund is rushing to replace a derisking solution as it seeks to update its investment strategy and target self-sufficiency.