All Defined benefit articles – Page 189

-

Opinion

OpinionKissing goodbye to complexity

From the blog: How many readers of this would travel to New York by boat?

-

Features

FeaturesGreenwich charts course to diversified alternatives

A radical change in investment strategy is underway at the Royal Borough of Greenwich Pension Fund, as it introduces new asset buckets for diversified alternatives and multi-asset strategies.

-

Opinion

OpinionFour problems with today’s LDI strategies

It is time to move on from outdated notions of liability-driven investment, says JPMorgan’s Rupert Brindley, and keep up with the strategy’s modern design.

-

News

S.Yorks misses deadline as admin woes heap pressure on LGPS

Teething issues following an administration overhaul at South Yorkshire Pensions Authority has delayed the delivery of members’ annual statements, amid a challenging backdrop of wider fundamental reform across the Local Government Pension Scheme.

-

News

NewsThe Pensions Trust reboots website in response to new rules

The Pensions Trust has relaunched its website with more tools and information for members, employers and advisers, as schemes look for ways to engage members amid an increasingly complex pensions landscape.

-

News

News‘Mindset shift’ in FTSE 100 battle to reduce DB risks

FTSE 100 defined benefit schemes flooded into bonds in 2014 but persistent deficits are forcing many schemes to seek opportunities for risk reduction within growth-seeking assets.

-

Opinion

OpinionScheme fragmentation more stark in private sector than public

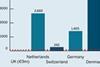

Data Crunch: The appointment last month of Edi Truell as the London Mayor’s new adviser on pensions and investments is part of an initiative, we are told, to amalgamate some of the country’s numerous public sector pension funds and aims to save billions of pounds through greater efficiencies, lower fees and improved returns.

-

News

Charity puts centre up for sale to cover LGPS costs

The Multiple Sclerosis Society is to sell a support centre to meet the cost of its local government pension scheme membership, the latest charity to sell assets to cover defined benefit costs.

-

News

NewsPolice investigation highlights need for internal scheme checks

The protection of scheme assets against internal fraud should be a top priority for administrators and trustees, experts have said, following the arrest of an employee on suspicion of a scheme-related theft.

-

Features

What trustees can learn from the British Airways wrangle

News Analysis: British Airways’ pending court case against the trustees of its Airways Pension Scheme over pension increases raises questions regarding how scheme trustees should interact with their sponsoring employer.

-

News

Regulator flags DLR case to tackle inaction on late valuations

The Pensions Regulator has taken the unusual step of publishing details of how it responds when schemes miss their valuation deadlines in an attempt to underscore the need for constructive dialogue between trustees and sponsors.

-

News

Cash leads the way on freedoms but further flux predicted

More than half of the £2.5bn withdrawn by pension savers in the three months since April has been paid out in cash lump sums, but experts predict consumers will shift their focus towards more sophisticated products.

-

Features

FeaturesDB closures 'storing up issues' for DC

News Analysis: The closure of defined benefit pension schemes may alleviate a significant financial burden, but experts have urged employers to think carefully about the long-term impact of the replacement arrangements chosen for affected employees.

-

News

Invensys extends Pie to pensioners

Invensys Pension Scheme is expanding its pension increase exchange offering to retired members, as the company plans a bulk exercise for dependants and pensioners.

-

Opinion

OpinionRising rates: Hope for the best, plan for the worst – don’t press pause

Trustees have been blighted by low interest rates since 2008 and uncertainty about possible rises continues to make it hard to plan. LCP’s Phil Boyle says schemes can still manage this risk.

-

Opinion

OpinionEurope: What UK schemes need to know about legal changes

European regulators have eased off on some of the more stringent requirements for trustees, but CMS’s Maria Rodia and Thibault Jeakings say trustees still need to keep up to date with legal changes.

-

News

Longevity v interest rates – which poses the biggest risk for schemes?

Rising life expectancy poses a greater risk to UK corporate pension schemes than low interest rates, a report this week has suggested, but some industry experts have challenged the finding.

-

News

BBC to lay on financial advice for members looking at transfers

The BBC is to offer paid-for independent financial advice to help members get the most from the pension freedoms, in particular to support those considering transferring their assets.

-

News

NewsCambridge uni scheme scrutinises opt-outs in prep for re-enrolment

Cambridge University Assistants’ Contributory Pension Scheme is examining the causes of opt-outs as it prepares to re-enrol members into its hybrid scheme next year.

-

News

East Riding moves deeper into niche alts in hunt for yield

East Riding Pension Fund has pushed further into the alternatives space over the past 12 months with an £80m investment in social housing plus increased allocations to aircraft leasing and healthcare royalties.