All Covenant articles – Page 16

-

News

Revised DB code emphasises integrated risk management

The Pensions Regulator this week released a new code of practice for defined benefit schemes, focusing on trustees and employers working collaboratively on scheme funding.

-

Features

Mercer parent shuts DB scheme to equalise benefits

Marsh & McLennan Companies, the US-based parent of global consultancy Mercer, has decided to close its UK defined benefit scheme to future accrual in a stated attempt to create a level playing field between employees.

-

Features

LPFA reports doubling in employers needing covenant review

The London Pensions Fund Authority’s risk-based approach to setting contribution rates has identified around twice the number of employers that may need to provide greater solvency guarantees after its recent valuation.

-

News

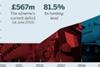

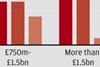

NewsBattle to plug deficits continues as FTSE 100 see £8bn deterioration

The total pension deficit of FTSE 100 defined benefit schemes worsened by an estimated £8bn, bringing the total to £57bn at the end of 2013, according to research, but experts maintain larger schemes are managing their risk exposures effectively.

-

News

Lafarge trustees seek merger assurances to protect members

The trustee board of Lafarge’s UK pension fund has begun discussions with its sponsor to ensure members would be protected under its proposed $40bn (£23.8bn) merger with Holcim to form a global cement maker giant.

-

Opinion

PPF: What our levy work means for your scheme

Talking head: Ahead of a May consultation on the changes to its levy framework, the Pension Protection Fund’s David Taylor discusses the organisation’s plans for judging sponsor insolvency.

-

Features

Lancashire increases employer contributions to mitigate maturing membership

Lancashire Pension Fund has added lump-sum payments to its annual employer contributions to make up for reduced cash flow from a declining active membership.

-

Features

FeaturesLafarge doubles contributions to cut deficit

Building materials manufacturer Lafarge has more than doubled its contributions to its UK pension fund after scheme and sponsor negotiated a beefed-up recovery plan to tackle the funding deficit.

-

News

Education key as employers stretch to reach pension goals

News analysis: Companies need to better educate staff to encourage responsibility for pension saving, as research has highlighted a misalignment between employers’ goals and the outcomes of their defined contribution plans.

-

News

Isle of Wight bolsters governance ahead of LGPS reform

Isle of Wight Pension Fund has identified areas ripe for improvement in its governance, including more frequent funding monitoring, as local government schemes brace for next year’s reforms to the sector.

-

Opinion

How to build your risk committee

As more defined benefit schemes follow a derisking plan towards their end point, monitoring and managing risk grows ever more important.

-

News

Scheme valuation process 'broken', consultants say

Industry figures have called the triennial valuation process poorly suited to help schemes assess their needs, with technological advances allowing trustees to instantly assess their scheme’s funding level.

-

News

Charities await guidance to reduce liability squeeze

Not-for-profit employers that belong to multi-employer schemes are waiting for further guidance on dealing with debt risk that could trigger insolvency.

-

Features

FeaturesManagers’ examples on reducing risks from 2013

Year in review: Pension managers and trustees took a variety of measures to protect their members’ benefits, Pensions Week reported over the past year, from more efficient administration software to covenant safeguards.

-

News

NewsSchemes take more holistic approach to risk management

News analysis: More schemes are taking an integrated approach to investment, covenant and funding in their risk management planning, but there is still a disconnect between schemes’ investment strategy and valuation process, according to research.

-

News

FDs urged to collaborate with trustees on DB deficits

Finance directors are making a “big mistake” if they think they can get defined benefit liabilities off their balance sheets without collaboration with trustees, a scheme manager told delegates at the 2013 NAPF conference.

-

News

NewsBA communicates with members on growth objective

The Pensions Regulator’s new objective to support employer growth has filtered through to members of the British Airways pension schemes, where trustees have met with the airline and regulator as part of the valuation process.

-

News

Essex council fund maps insolvency risk

Essex Pension Fund has produced a map to help predict employer insolvency after a liquidation left it saddled with orphan liabilities.

-

News

Experts divided on takeover code change implications

Legal experts are split on whether changes to the takeover code coming into effect today have any impact on the power of pension schemes whose sponsors are the target of a merger or acquisition.

-

Features

FeaturesBAE ups debt guarantees to safeguard benefits

The defence company has increased debt guarantees to a level where it qualifies as a PPF contingent asset, potentially reducing the cost of its PPF levy