All Brexit articles – Page 4

-

Opinion

OpinionActivating better DC outcomes

Defined contribution investment should not rely on the up and down of global stock markets alone, says AB’s Karen Watkin.

-

News

Rising gilt yields: Inflationary worry or time to buy?

Recent weeks have seen 10-year gilt yields reach 1.16 per cent, their highest level in four months, in a sign inflation is creeping up in the UK economy.

-

Features

DWP silence on GMPs blocks Smiths implementation

Two UK defined benefit schemes operated by technology company Smiths Group have said they will implement guaranteed minimum pension equalisation but need further clarification from the Department for Work and Pensions to do so.

-

Opinion

OpinionThe Brexit effect on schemes and stats

The Society of Pension Professionals’ Hugh Nolan explains why making sense of financial stats can be tricky when Brexit is involved.

-

Features

FeaturesInvensys swaps linkers for nominal in hunt for cash flow

The Invensys Pension Scheme has extended its commitment to fixed rate gilts, as low portfolio risk and a strong covenant allowed the £4.9bn scheme to weather worsening conditions in the broader UK industry.

-

News

HMRC buys more time on EU VAT issue

HM Revenue & Customs has delayed its guidance on alternative solutions for employers seeking to recover value added tax on defined benefit pension administration costs, prompting speculation that a decision will not be made until Brexit negotiations advance further.

-

News

Schemes urged to revisit risk as deficits soar

Defined benefit pension deficits have escalated since last month, but despite the challenging environment and gloomy outlook, some experts say schemes should stay calm and consider re-evaluating their risk portfolios.

-

News

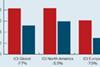

NewsEurope sneezes, the world catches cold: ICI falls 7.7 points in a month

State Street’s monthly Investor Confidence Index for July fell by 7.7 points globally from June, driven primarily by a drop in the European index following recent turmoil in the region.

-

Opinion

OpinionWaiting for the sunshine: The challenges facing DB

The Pensions and Lifetime Savings Association’s Graham Vidler sets out the difficulty facing defined benefit schemes following Brexit, and explains how the PLSA will work to help the industry weather the turbulence that has followed the vote.

-

News

NewsWebb: New face at DWP will not loosen Treasury's grip on pensions tax

Philip Hammond’s appointment as chancellor of the exchequer is unlikely to see the Department for Work and Pensions regain control of pensions reform, according to former pensions minister Steve Webb.

-

Features

LPP pools £1.2bn of property amid investor fears over asset class

The Local Pensions Partnership has created a £1.2bn property pool between the London Pensions Fund Authority and Lancashire County Pension Fund as experts have urged schemes not to panic over the recent gating of UK retail property funds.

-

News

Regulator’s annual statement omits Brexit implications

The Pension Regulator’s 2015-2016 annual statement has pinpointed the main changes and risks the UK pension industry faces, but has not taken into account recent economic turmoil and its effect on the pensions landscape, industry experts have said.

-

Opinion

OpinionData crunch: Scale of UK institutional market eases Brexit fears

Will asset managers shun the UK following Brexit? Spence Johnson’s Magnus Spence argues that, looking at the numbers, this is unlikely.

-

Opinion

OpinionWhat does the new IORP directive mean for UK schemes?

DLA Piper’s Matthew Swynnerton sets out the key points UK schemes should be aware of in case IORP II is implemented in the UK.

-

News

What will the Leave vote mean for Project Pool?

As the July 15 deadline for local government pension schemes to submit their asset pooling proposals approaches, experts have warned local schemes to expect delays to ‘Project Pool’ following the Brexit vote, but cautioned other obstacles might also arise.

-

Opinion

OpinionBrexit makes intergenerational equality a top priority

Redington’s Rob Gardner calls on the industry to help young people, who stand to lose most after the Brexit vote.

-

Opinion

OpinionPlaying the waiting game

Editorial: As the reality of the leave vote is sinking in, the British stiff upper lip is invoked incessantly by the pensions industry in an attempt to convince themselves and each other that things can’t be as bad as they are.

-

News

Brexit creates opportunity but uncertainty remains, experts warn

Scheme trustees should look to capitalise on opportunities created by the United Kingdom’s vote to leave the European Union, but strategic change should wait until details emerge, experts have said

-

Opinion

OpinionTake a deep breath: Brexit might not change much for schemes

Caroline Legg from law firm Sackers looks at what last week’s ‘leave’ vote might mean for UK pension funds.

-

News

NewsPensions shrouded in uncertainty as UK votes to leave

The pound fell on Friday following news the United Kingdom had voted to leave the European Union, but experts warned schemes not to overreact.