All Investment articles – Page 93

-

News

NewsBritish Steel pensions rule change proposals shelved

The government has reportedly put aside plans to change pensions legislation that would allow Tata Steel UK’s pension scheme to stay out of the Pension Protection Fund, according to insiders briefed on the issue.

-

Features

FeaturesRoyal Mail diversifies alternatives ahead of planned scheme closure

The Royal Mail Pension Plan has diversified the alternatives investments in its portfolio, adding new private debt and infrastructure funds, while almost eliminating its exposure to equities in one of its sections.

-

News

News'Patchwork quilt' of solutions threatens drive for transparency

Regulators and consumer groups have been warned against installing a “patchwork quilt” of solutions to increase transparency in asset management, as remedies to hidden charges within funds begin to emerge.

-

Features

FeaturesInvensys swaps linkers for nominal in hunt for cash flow

The Invensys Pension Scheme has extended its commitment to fixed rate gilts, as low portfolio risk and a strong covenant allowed the £4.9bn scheme to weather worsening conditions in the broader UK industry.

-

News

Schemes embrace fid man, but not third-party advisers

Trustees are reporting high levels of satisfaction with fiduciary management, research from consultancy Aon Hewitt has shown, but some experts still raised concerns about appointments and monitoring.

-

Features

FeaturesNilgosc turns to low vol equities

The Northern Ireland Local Government Officers’ Superannuation Committee has made a £300m allocation to low volatility global equities in an effort to reduce overall risk while closing its funding gap.

-

Features

FeaturesCAF exits multi-employer scheme to set up own fund

The Charities Aid Foundation has withdrawn from a multi-employer defined benefit pension plan and established a new DB scheme, removing its exposure to other employers’ pension liabilities.

-

News

Hounslow commits £100m to multi-asset income

The London Borough of Hounslow Pension Fund has introduced a £100m allocation to multi-asset income in an effort to diversify as it moves towards being cash flow negative.

-

Features

Desire for better data sparks mortality study for Star Group

Star Group has decided to conduct a medically underwritten mortality study for its defined benefit scheme, as it works on tackling an increased deficit while reducing investment risk.

-

Features

FeaturesVodafone scheme diversifies with alternatives additions

Vodafone has made a foray into a number of new asset classes, including alternative beta, alternative credit and private market investments, for greater diversification.

-

Features

FeaturesBBC aims to drive down fees in private markets strategy

The BBC scheme lowered its overall investment management fees by £3m over five years, while further increasing its significant exposure to private markets, a move the scheme says allows it to match liabilities at the same time as generating capital growth.

-

News

NewsGovernance is key as dispute rocks asset management industry

Research suggesting that hidden fund fees are the “Loch Ness Monster of investments” has sparked the latest round of a bitter row between the Investment Association and pro-transparency groups.

-

News

Pension schemes steer clear from selling gilts as rate pain intensifies

Pension funds struggling with low yields have held back from selling long-dated government bonds, causing the Bank of England to miss its gilt buying target on Tuesday.

-

Opinion

OpinionHow to make your providers work harder

Competition in the asset management sector is under scrutiny in the Financial Conduct Authority’s market study, but schemes can act now to get a better deal, says Avida International’s Paul Boerboom.

-

News

Hedged Aviva schemes survive rate cut

Pension schemes sponsored by insurance giant Aviva have reported a marked increase in their accounting surplus owing principally to falling interest rates, but experts warn of further pain for schemes which are not hedged against interest rate risk.

-

News

NewsRailways scheme on track with cost management

The Railways Pension Scheme has saved £100m in fees, having restructured its external management and pooled fund arrangements, but despite being cost-conscious, the fund remains focused on net returns.

-

Features

FeaturesRSA scheme targets buy-and-maintain strategy to derisk

The RSA Insurance Group’s Sal Pension Fund is focusing on buy-and-maintain credit as part of an investment strategy overhaul as the scheme looks to further derisk its portfolio following the results of its latest actuarial valuation.

-

News

Expertise key to exploiting multi-asset solutions

Schemes looking to multi-asset strategies to generate positive cash flow while derisking may have to turn to specialist managers to reduce their potentially significant governance burden.

-

News

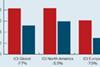

NewsEurope sneezes, the world catches cold: ICI falls 7.7 points in a month

State Street’s monthly Investor Confidence Index for July fell by 7.7 points globally from June, driven primarily by a drop in the European index following recent turmoil in the region.

-

Opinion

OpinionHow technology can help us tackle the challenges ahead

JR Lowry from State Street Global Exchange looks at how technology can help schemes overcome the challenges the pensions system faces as a result of massive change.