A catch-up on the government's official research on quality and charges in defined contribution pension schemes, featuring stats, views and analysis on the key issues for scheme professionals.

The headline findings

The average annual management charge for trust-based schemes is 0.75 per cent, up from 0.71 per cent at the last survey in 2011. In contract-based schemes, the average AMC was 0.84 per cent, down from 0.95 per cent in 2011.

Smaller schemes, older schemes, those with lower contributions and a commission-based adviser charged more to their members.

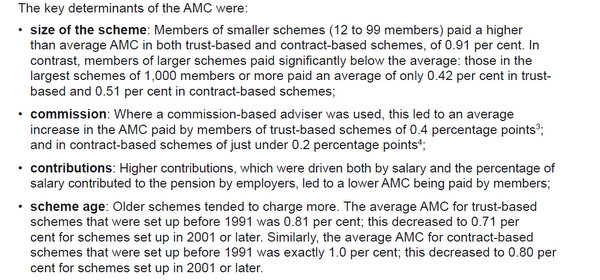

The report stated:

Source: DWP

Charges

Here is how those charges were broken down across trust and contract-based scheme structures:

The findings led to calls for the government to consider again a charges cap on pension schemes that are used for auto-enrolment. The introduction of a cap has been delayed until April 2015.

DWP pension charges Survey shows small schemes and lower earners pay higher fees - need protection, TER cap, not AMC http://t.co/pH8Mt9KQkb

— Ros Altmann (@rosaltmann) February 18, 2014Charges higher with commission-based advisers, says new DWP research https://t.co/l6l1tpGHSG . Govt could ban this before capping charges.

— David Robbins (@David_J_Robbins) February 18, 2014The government duly responded by restating its intention to cap charges, with pensions minister Steve Webb telling The Telegraph: "We are finalising our plans now. We are absolutely committed to ensuring value for money."

The vast majority of charges were made as a proportion of a member's fund, rather than of their contributions or a flat fee. The survey found 84 per cent of trust-based schemes charged members in this way, compared with 90 per cent of their contract-based counterparts.

Contributions

The research also featured an interesting summary of scheme contribution structures. The average salaries of trust-based and contract-based scheme members were very close, at £26,000 and £26,500 respectively.

Comparing trust and contract-based schemes across different membership groups found that the smaller the scheme, the lower the contribution level – particularly in contract-based arrangements:

Interestingly, in contract-based schemes, proportional employer and employee contributions generally increased with salary – the employee's input rising from 3.1 per cent for those on less than £20,000 to 4.6 per cent for those on more than £40,000.

In the trust-based world, employer contributions rose with salary but employee contributions did not. The employee here paid 3.5 per cent at the lower income level, and 3.2 per cent at the higher level.

Governance

Unsurprisingly for a survey of this market, the DC governance question reared its head, with various statements made around the adequacy of trust-based, mastertrust and contract-based schemes' committees.

"The committees responsible for contract-based schemes might not behave in as impartial a way as trustee bodies, since they were not truly independent," the report stated.

But nor did the survey respondents see trust-based governance as unimpeachable. "Providers were concerned that, while trustees were usually engaged and diligent, the lack of regulation around employer-based trustee boards meant that the quality of governance varied widely," the DWP reported.

Excluding auto-enrolment considerations, around half of employers had reviewed their pension schemes in the past year.

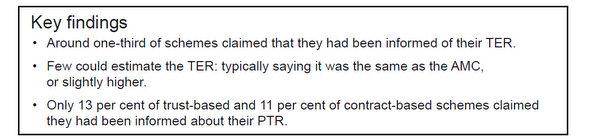

Few schemes could estimate their total expense ratio, and only around one in 10 said they had been informed about their portfolio turnover rate:

Source: DWP