From the blog: The future for final salary pension provision looks bleak. So goes the rhetoric: benefit rules, tax changes, EU legislation, the Pension Protection Fund levy, accounting rules and more – each has been blamed for increasing costs and hammering that final nail in the defined benefit coffin.

Yet significant legacy liabilities remain and need to be proactively managed. Many schemes still stand, proudly embracing this challenge, and the trailblazers of these new frontiers are often the big schemes.

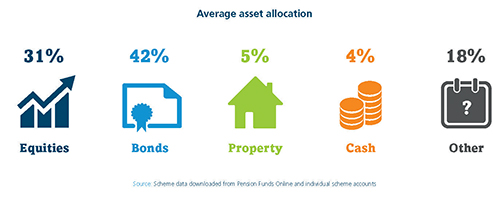

As pensioners become an increasing proportion of a scheme’s membership, there is a trend to move away from growth assets (such as equities) and into those which better match pension payments.

Big schemes are no exception....